Voiding Accounts Payable Checks

You can only void a AP check if the payment was made in a month that has not been Closed. AP Invoices that have been paid are normally dropped from the system during the Update for a Period Close. If you have closed that month and dropped it from the system (during close) then you will not be able to use the Void Check, and must Manually Void the Check. See the Manual Method below to show you how to manually Void an A/P check.

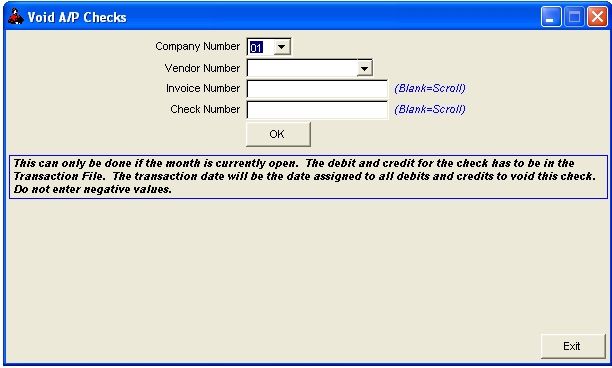

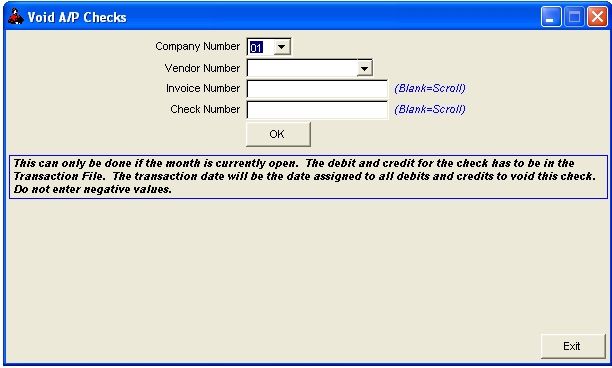

Select AP - Void Checks

NOTES ON FIELDS FOR VOID CHECKS

COMPANY NUMBER: The company number you want to void the check.

VENDOR NUMBER: This is the vendor number used for the payment. You may NOT change the vendor's number. If the payment was entered to the wrong vendor, delete the payment, pack your files then reenter the payment.

INVOICE NUMBER: You can enter the invoice number of the payment or you can leave this field blank and Roughneck will scroll through all payments for the vendor.

CHECK NUMBER: If you know the check number you can enter it or leave it blank to scroll.

DEBIT G/L NUMBER: This is usually your cash account

TRANSACTION DATE: The date you want the voided check to show up.

DESCRIPTION: The description will only show up in the Transaction file. It will print on your Monthly Transaction Listing and on your Trial Balance.

You will need to enter your Company number and Vendor number. You are able to Scroll for the Invoice and Check number. Once you find the payment you need to void click on the Void button. You will then need to enter your Cash account and the transaction date you want to show up as a voided check. Click OK, then your check has been voided. A voided check will show up as a Type 4 account on your A/P Inquiry & Posting Register as well on your Monthly Transaction Listing.

MANUAL METHOD OF VOIDING AP CHECK

If the paid AP invoice has been dropped from the system during Period Close, you need to redeposit the returned vendor check to make your cash account correct.

Enter the voided check in the Transaction file using Enter a Journal Entry.

Debit - 11010- Cash account for the amount of the check.

Credit - the Expense GL number- you originally posted to for the invoice.

Note: Be careful not to bill the Investors or the unit again for this expense, if they have already been billed - so don't enter a Unit Number.

Add a new invoice in Accounts Payable to the correct vendor if a check was issued to an incorrect vendor.

Note: Again, be careful not to bill the Investors or the unit again for this expense, if they have already been billed - so don't enter a Unit Number.

Roughneck Help System 02/15/07 10:30 am Copyright © 2006, Roughneck Systems Inc.